|

[VIEWED 51980

TIMES]

|

SAVE! for ease of future access.

|

|

|

|

|

|

wheel

Please log in to subscribe to wheel 's postings.

Posted on 04-14-09 7:08

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

|

|

| |

|

|

|

|

yuma

Please log in to subscribe to yuma's postings.

Posted on 04-14-09 9:49

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

robin pyaanday...thks for the info

|

| |

|

|

fortunefaded

Please log in to subscribe to fortunefaded's postings.

Posted on 04-14-09 11:39

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

lol...how the hell is this 'info on how to trade stocks and forex?' The guy gives us no insight. At least give us some information about where he thinks the market is heading? Even I can pull out charts and read out the prices at levels of resistance and support. And what was the point of putting the clip of fast money? If you want some good technical analysis on the market, check out the clip below from alphatrends.net:

|

| |

|

|

AAAA

Please log in to subscribe to AAAA's postings.

Posted on 04-15-09 7:54

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

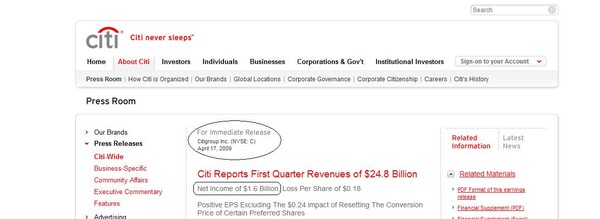

i agree with ff. the video does not provide any insight on how to invest, how to trade, what are good stocks in current market to invest on and so on. all he did was explaining about the citi bank graph, showed from clip from msnbc and thats it. anyone can get such information from various internet sites.

|

| |

|

|

wheel

Please log in to subscribe to wheel 's postings.

Posted on 04-15-09 9:51

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Fortunefaded and AAAA, You are right the clip you have selected above does provide insight of technical analysis, and it is useful for expert traders like yourself. The information I was providing above is more or less for novice traders or people who have not traded any stocks or other financial instrument to give them ideas about the financial market. And I provide both technical and fundamental analysis. If you look at all of my videos, you will see I have done some technical analysis, and it is structured for novice traders. Also, in my classroom I do both and it is more interactive since the trader/investor can stop me and ask a question. Since, I just started to present You Tube videos, I have yet to receive feedbacks from viewers, and I appreciate the feedback, and that gives me ideas about viewer demand. I have put out about six videos so far, and in a couple of videos, I am only doing technical analysis. The format of my videos is generally to give the overall market information. As I hear more feedback from viewers, I will tweak it to according to the demand. Also, when I am day trading, I look at various information before I place a trade. Some people like fundamental analysis and some people like technical analysis, but I use both. I also use various financial instruments and trade which one makes the most sense to me, and so far this method has been profitable for me over the course of time. My stock trading experience began in 1986, forex trading experience began in 2003, and real estate investment in 1997. And, I hope to provide you both fundamental and technical analysis of overall financial market to invest/trade and profit. My pick of stock was Citi group, which is very inexpensive and you can buy a lot of shares with little investment. I presented technical chart, and I presented CNBC clip to point out fundamental analysis to show how the Citi group stock was affected by the market sentiment led by Goldman Sachs, and I am sure some of the traders got my drift. In other words, the format and structure depends on an individual style and preference, and technical analysis seems more scientific and appeals to a lot of beginner traders. Here is another FREE info that might be valuable to you. Market is volatile right now, and there is no clear direction, and DOW is hovering in positive territory today after two days losses. Some of my suggestions are to buy Oil stocks, and financial stocks. If you are young and want to take some RISK buy GM their stock is dirt cheap, and if they pull themselves out of bankruptcy your investment will be very profitable. I personally have Citi group shares, and it is less risky and could be modestly profitable. Citi group is releasing their first quarter report on 6:30am on 4/17/08, and I am positive Citi will have profits. This news ought to push Citi stocks higher. I appreciate feedbacks and comment to make the You Tube show more enjoying and insightful. I know some of you complained about the sound and said I was talking too fast on video above, and I will try to go slower and improve the sound and video quality in the near future. I hope this information was more insightful and helpful to you. Good luck in your investment/trading venture. Feel free to send comment, concerns or questions or share your trade stories. Best Wishes, Robin Pandey

robin.pandey@rgifx.com

Mount Everest Financial Institute

|

| |

|

|

fortunefaded

Please log in to subscribe to fortunefaded's postings.

Posted on 04-15-09 11:47

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

"Citi group is releasing their first quarter

report on 6:30am on 4/17/08, and I am positive Citi will have profits.

This news ought to push Citi stocks higher."

I disagree. Even when Goldman reported better than expected profits, GS stocks slumped the next day. Same thing happened with Intel. The market has already factored the profits into the price of Citi stocks and I would wait till Friday to see how it responds. Citi's stock was getting a bump due to Wells Fargo's huge profit report. Unless Citi reports that kind of profit, I don't see the stock going anywhere.

Also, have you check out the volume on short interest on Citi? It's the highest since last April.

|

| |

|

|

fortunefaded

Please log in to subscribe to fortunefaded's postings.

Posted on 04-15-09 11:58

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

One more thing, By no means am I an expert on trading. You have far more experience than I do. In fact, I got into technical analysis just a few months ago and I am still learning a lot. I didn't want to discourage you from posting your videos. It's good to see a Nepali trader taking some initiative. It would be great if you could do one video a week, and talk about some stocks, backing your statements with technical analysis. I am sure people would like to know what kind of indicators you use during this volatile market. Peace, FF.

|

| |

|

|

Riten

Please log in to subscribe to Riten's postings.

Posted on 04-15-09 12:03

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

So besides Citi (whether to buy now or wait until Friday), what other stocks would you recommend? And why?

|

| |

|

|

database

Please log in to subscribe to database's postings.

Posted on 04-15-09 12:33

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Mr Pandey, I appreciate your effort to educate novice investors but I could not agree much in your input regarding GM and also you did not provide much information for your buy recommendation on C. Why do you thnk GM is so cheap?Other than just a speculation,Why do you think GM worth risk taking? Thanks in advance for your analytical answer.We are not expecting just a speculation.

|

| |

|

|

avicobain

Please log in to subscribe to avicobain's postings.

Posted on 04-15-09 12:48

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

If only you had said BAC rather than C, I would have bought your statement. By the way, Citi is not going to post profit. This is going to be 6th quarter of loss for them. The stocks will go up for sure coz the losses will be lesser than before (expected quarterly loss of 33 cents per share).. Agree with FF..!!! Disclosure: I have thousands of BAC picked up at 4 (you know why I am pushing it..:))

|

| |

|

|

wheel

Please log in to subscribe to wheel 's postings.

Posted on 04-15-09 5:59

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I really appreciate the feedbacks. When I did the video I was busy with doing taxes, trading, and picking up my daughter from daycare. In the afternoon when I wrote Citigroup was trading at 2.70 now it is at 4.15. That is whopping $1.45/share profit. 100,000 shares * 1.45 = $145,000 profit on $270,000 investment. You guys are smart and analytical, I will let you do the math on percentage. Again, I do appreciate feedbacks.

|

| |

|

|

wheel

Please log in to subscribe to wheel 's postings.

Posted on 04-17-09 8:05

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

![]()

FORECAST RESULT

THOSE IDIOTS IN WALL STREET DID NOT KNOW, BUT I KNEW.

ROBIN PANDEY

23 years of stock trading experience

COMPANY - Mount Everest Financial Institute, LLC, Columbus, OH

EDUCATION - B.S. in Economics 1992, Northern Illinois University

MBA 2003, New York Institute of Technology

TOTAL PROFESSIONAL EXPERIENCE - 15 Years of professional experience in management, investment and trading services, and other industries including fortune 500 industries.

FORECASTED ON 04/15/05 - CITIGOURP WILL BE PROFITABLE. BOUGHT CITIGROUP AT $1, $2, AND $3 range.

04/17/2009 - NEW YORK (CNNMoney.com) -- Citigroup surprised Wall Street Friday as the company delivered its first profit in more than a year, helped by strength within its investment banking division.

C H E E R S

Last edited: 17-Apr-09 09:33 AM

|

| |

|

|

database

Please log in to subscribe to database's postings.

Posted on 04-17-09 8:22

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Did I read something wrong?Did citi post profit for this quarter? No doubt ,citi did post better result than analyst estimates Citigroup's quarterly loss available to common shareholders narrowed to $966 million, or 18 cents per share, from $5.19 billion, or $1.03, a year earlier. Revenue roughly doubled to $24.79 billion. Analysts on average had expected a loss of 30 cents per share on revenue of $21.73 billion, according to Reuters Estimates. http://www.reuters.com/article/ousiv/idUSTRE53G25L20090417

|

| |

|

|

Riten

Please log in to subscribe to Riten's postings.

Posted on 04-17-09 8:39

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Whhaaaattt??? Robin, aka Wheel: Where on earth did it say that Citi showed a profit? Or did you jump to conclusion after reading just the first line in CNN Money? Read further and you will see what Database posted above. C'mon now! Gotta have the facts straight if one professes to teach others about investing.

|

| |

|

|

incrediblesuperbatma

Please log in to subscribe to incrediblesuperbatma's postings.

Posted on 04-17-09 8:58

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

As an accountant working at stockbrokers in London, I keep myself abreast of most of the financial news. These profits posted by JP Morgan, Citigroup for the first two months of this quarter and was it Goldman couple of days back, is all down to revision of American accounting standards under the pressure of authorities whereby the assets held as investments in their balance sheet are being valued at cost rather than the Net present value or what they can fetch from the market in an arms length transactions. Hence there is no write downs to be posted onto their income statement converting the loss into profit. Its all down to creative accounting I suppose. I will post the article on economist for this if I can find it again. Even European International Accounting Standards are coming under pressure to change the strict standards on asset valuation which hasn't happened yet. If you really want to bet on Stock try, CFDs and Spreadbetting. You can earn loads as well as loose loads if things go the opposite way. The financial info are normally free on all stockbroker websites once you become the account holder. Anyone interest in investing in stockmarket can email me however, as I am UK based, there is further risk of currency fluctuations if you do decide to invest.

|

| |

|

|

inpeace

Please log in to subscribe to inpeace's postings.

Posted on 04-17-09 9:35

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

70 millions sold on Citi...Anyone holding Citi consider getting out..

|

| |

|

|

Gay Goat

Please log in to subscribe to Gay Goat's postings.

Posted on 04-17-09 9:48

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Robin Pandey. Your company, Mount Everest Financial Institute, LLC, could not be verified by Business License registration on Colombus, OH, city government web sites. If you have worked for a financial institute or have a financial institute, you need a brokers license. That also could not very verified by FINRA Brokercheck. I do have a MBA and my job is day-trading and taking care of my kids and wife. One thing is sure, Citi is a great stock. Good day!!!

|

| |

|

|

incrediblesuperbatma

Please log in to subscribe to incrediblesuperbatma's postings.

Posted on 04-17-09 9:53

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

the market ticker is showing share down by 5.49% today at $3.79. Btw the website http://www.rgifx.com/index.htm that Robin hosts doesn't look very appealing. You need to revamp your site mate. Also you don't have registration to any regulatory body it seems. Is it not illegal to trade as financial services company without subscribing to the regulatory body or maybe the service you provide doesn't need to be regulated.

|

| |

|

|

wheel

Please log in to subscribe to wheel 's postings.

Posted on 04-17-09 9:53

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Stock trading is time sensitive, and you may have to move quickly to get in and out. Below is what I posted on "Stock Trading Presentation" yesterday about possibly exiting from Citi shares today. However, as an experienced trader, I am not exiting my position yet because people are just reacting now, and I am going to take the risk because eventually, it is going to come up. However, I do not suggest holding it either to new traders. That is why stock trading needs guts my friends. If you just want to read information, then you might just as well be an accountant, no offense batman. In a few days later, I will come back and say I told you so. Just like I told you about Citi profit on April 15th. And the Citi profit report I posted above, I pulled right out of Citi website.

Last edited: 17-Apr-09 09:54 AM

Last edited: 17-Apr-09 09:54 AM

Last edited: 17-Apr-09 09:55 AM

Last edited: 17-Apr-09 09:57 AM

|

| |

|

|

dhoti_prasad

Please log in to subscribe to dhoti_prasad's postings.

Posted on 04-17-09 10:05

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

|

|

| |